Last updated on April 3rd, 2024 at 12:08 pm

CEO Rene Haas states that the UK-based company is capitalizing on significant demand for AI-powered products and applications

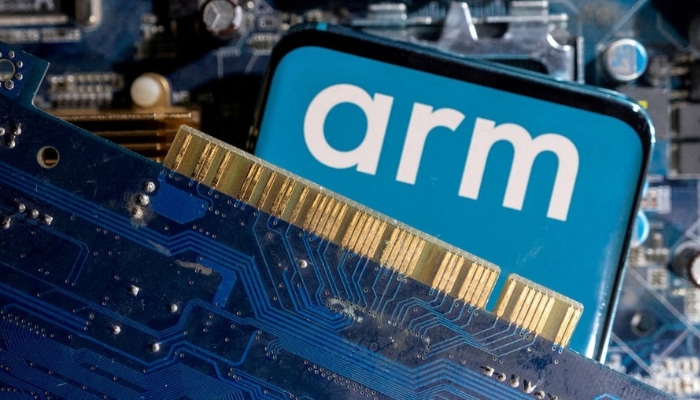

Arm’s shares have surged by over 50% after revising its profit and revenue forecasts, driven by high demand for artificial intelligence technology. This increase in value now values the UK-based tech company at double the market capitalization since its IPO in September.

The world’s largest supplier of design elements for processing chips, used in various products from smartphones to gaming consoles, saw its shares open 58% higher on the Nasdaq in the US on Thursday. This investor excitement drove Arm’s share price above $122 within hours, valuing the company at around $120 billion.

This valuation is more than double the $51 per share offered during the IPO in New York last September by SoftBank, Arm’s parent company, which chose to list the business in the US over the UK.

Arm’s CEO, Rene Haas, highlighted on Wednesday the significant growth opportunities stemming from the demand for AI-driven products and apps within the tech industry.

Despite being predominantly owned by SoftBank, with a 90% stake, Arm’s latest earnings report exceeded analyst expectations, with revenues increasing by 14% year-on-year to $824 million in the final quarter.

The company raised its full-year revenue and profit guidance, attributing this success to rising demand for its designs to power AI applications, along with a resurgence in smartphone sales.

However, Arm’s initial quarterly report in November was less positively received by investors due to a $500 million remuneration cost incurred after its New York listing. This cost was related to settling outstanding shares previously granted to employees.

It seems Arm is navigating these challenges and capitalizing on growth opportunities, positioning itself as a leader in the AI technology landscape.

SoftBank’s choice to list in the US, despite strong lobbying efforts by the UK government, was a setback for Rishi Sunak’s goal of establishing London as the premier destination for tech company IPOs.

Arm was previously dually listed on both sides of the Atlantic before being acquired by SoftBank for £24.6 billion in 2016. It had been a member of the FTSE for 18 years.

The chip designer, which committed to maintaining its headquarters, operations, and “material intellectual property” in the UK, suggested that it might consider a secondary listing in London “in due course.”